Disabled Mom Fights Wells Fargo Foreclosure, Alleging Fraudulent Filings

Brooklyn, NY- February 9, 2025 – A disabled mother is taking on banking giant Wells Fargo to save her family home from foreclosure, alleging the financial institution procured the foreclosure by fraud.

Christina Vassallo suffers a life-threatening and debilitating disease called Churg-Strauss Syndrome and has heart failure, but she is determined to fight for her home. “I may die, but I am fighting for my daughters’ security and for homeowners victimized by banks acting above the law”, says Vassallo.

The case is Wells Fargo Bank v Christina Vassallo, New York Second Department, appellate Docket 2022-03172. Click each item below to read the documents:

- Vassallo’s appellate brief with exhibits

- Vassallo’s doctor’s medical affidavit

Vassallo’s appeal shows that Wells Fargo’s own filings prove it never had an endorsed promissory note to foreclose on her home, a fundamental requirement in foreclosure law.

“New York law is well settled in U.S. Bank N.A. v. Moulton, 179 A.D.3d 734 (2d Dept 2020) that a bank must establish possession of an endorsed note with words written on it that the bearer has physical possession of it and signed by the prior note owner,” says prominent attorney Susan Chana Lask, representing Vassallo on appeal after her first attorney abandoned the case.

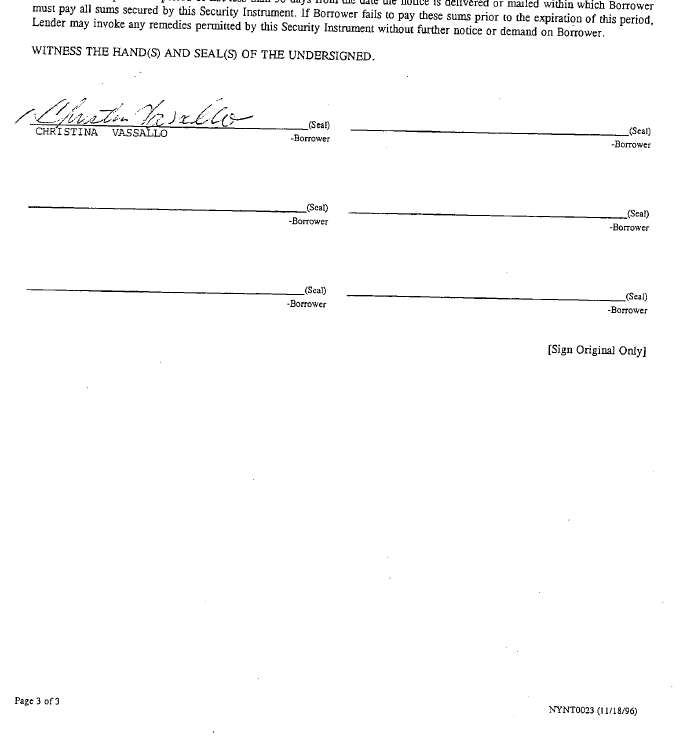

The note Wells Fargo produced was a three-page copy of a documents, with the third page having five inches of white space beneath a signature line where an endorsement could have easily been stamped, but it was blank, says Vassallo’s filings with an exhibit showing the Note was never endorsed (see picture below)

“The Moulton case directs that a paper called an allonge can be an endorsement if a bank representative swears in an affidavit that they examined the original note and that an allonge is “firmly affixed” to it, meaning stapled; but Wells Fargo never produced that because in 2006 the bank admitted the note was lost,” says Lask.

“If a bank engages in foreclosure fraud – especially against a disabled mother- it is not only illegal but it’s a moral failure that we will hold Wells Fargo fully accountable and insure that no court fails a homeowner by such a miscarriage of justice,” says Lask.

Lask knows foreclosure fraud well as her lawsuit in 2010 for another client exposed disgraced attorney Steven Baum who operated New York’s notorious Foreclosure Fraud Mill. Lask won a significant settlement against him then she assisted the Department of Justice and Congress to shut down Baum.

In 2022, Wells Fargo was ordered to pay $3.7 Billion Dollars by the Consumer Financial Protection Bureau (CFPB) for its illegal activity that harmed millions nationwide, including its wrongful foreclosures. See https://bit.ly/42Ttsit

Lask Reverses Client’s $25k Family Court Sanctions Because of Former Lawyer

Lask Reverses Client’s $25k Family Court Sanctions Because of Former Lawyer